miiCard today announced a move to target the US market following increased market traction globally for miiCard’s online identity verification service. This strategic expansion is in direct response to the Internet’s identity crisis and the US government’s National Strategy for Trusted Identities in Cyberspace (NSTIC) initiative.

Today’s news reflects heightened consumer concern around the issue of online identity in the US and growing demand worldwide for a way to create trust and protect people’s online identity, which was identified as one of 2012’s key technology trends by Deloitte earlier this year.

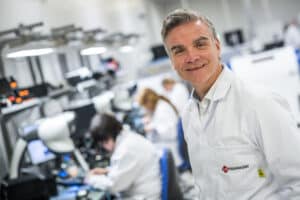

“miiCard’s pioneering digital passport is the only commercial product able to prove someone’s online identity, not only for financial services but across the board in e-commerce, online dating and social networking,” said James Varga, miiCard CEO, “miiCard puts users in control of their online identity and instantly enables them to create real trust online.”

miiCard lets users prove ‘I am who I say I am’ online, in real-time and with the same level of assurance that a passport or driver’s license carries offline. Owned and managed by the individual, miiCard is a federated identity service that centralizes the management and control of your online identity.

miiCard’s innovative use of Yodlee’s patented Personalized Finance Platform enables miiCard to establish a consumer’s identity by using information only the account holder would know. Along with a number of additional security measures, including email verification and 2-factor authentication via sms, miiCard can validate a consumer’s identity to the fullest extent of applicable anti-money laundering and know your customer standards.

miiCard’s use of the Yodlee Platform will allow financial services and ecommerce sites around the globe to offer online versions of products and services that have historically required offline identity checks. In addition, miiCard can also be made available as a Yodlee FinApp™, available for distribution across Yodlee’s Personalized Finance Platform and network of banking customers and partners.

“Your financial accounts and transactions history don’t lie,” said Yodlee’s Chief Marketing and Strategy Officer, Joseph Polverari. “miiCard’s innovative use of the Yodlee Platform will take the friction out of many legacy identification methods, dramatically reducing customer abandonment and making critical products and services more accessible to more consumers around the world.”

James Varga, miiCard CEO, comments: “Right now, digital identity is one of the most talked about technology topics. From social networking to banking, the need to create trust online is becoming ever more important. Our relationship with Yodlee means miiCard is the first commercial solution to the problem of how to prove ‘you are who you say you are’ online.”

Vendors accepting miiCard as proof of online identity benefit from increased conversions by supporting a live and purely online sales process, reduced cost of execution by not having to validate an identity offline or physically, and additional fraud and identity theft protection equivalent to a class 2 verification.

For more information please contact Sally Rattray.