miiCard has appointed three key board members, Stephen Brannan, Graham Paterson and David Ball – bringing heavyweight financial services and investment expertise to the company at a vital point in its growth.

miiCard has developed a purely online digital passport service that brings trust to the Internet by proving the user’s identity to the same level as a driver’s license or photo ID. It closed its first funding round and completed a management buyout earlier this month and plans a beta launch later this year. The three new board members recognise that miiCard is at a critical stage in its success path and will bring their own expertise to help it reach its full potential.

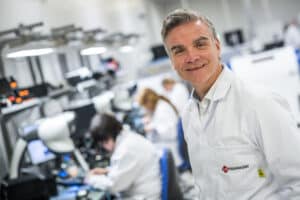

Stephen Brannan has spent 15 years at Royal Bank of Scotland, latterly as director of Separation Business Services, and has extensive experience of the international banking industry. After leading the separation of a number of businesses acquired under ABM AMRO as part of the RBS Group’s strategy to return to stand-alone strength, and further disposals dictated by the European Commission in return for state aid, he most recently managed the separation process necessary for Santander to purchase parts of the RBS retail network. Brannan also ran the RBS Cards business from 1999 to 2004, so has a thorough understanding of miiCard’s needs.

A highly respected figure in UK banking, Stephen Brannan will bring expert guidance to miiCard as it builds on its recent funding success and management buyout.

Graham Paterson was one of the founding partners of SL Capital Partners LLP and played a major role in the growth of that business from a team of two, with assets under management of £200 million, to a team of 40 and assets under management of £5 billion. An experienced and decisive senior executive, Graham brings extensive investment experience to the table.

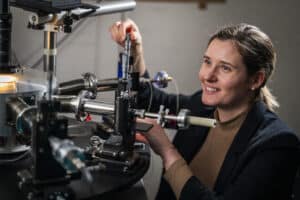

David Ball has held board positions with Tesco Bank and senior roles at HBOS plc and Bank of Scotland, managing IT and business transformation programmes.

Together the three new appointments strengthen the miiCard board enormously, bringing insight and understanding of relevant industries and business management practices.

Stephen Brannan says: “There’s a huge opportunity here – there’s nothing else like this available, and, the timing is perfect – if online commerce is to continue to function properly we need to create secure identity procedures. I know my experience and background in financial services can help miiCard reach its potential, so it will be an exciting time, working with the team to find all the applications for this great product.”

miiCard, the revolutionary digital passport, closed its first funding round on September 1, 2011. Raising a total of £550K seed funding from VC, angel and the public sector sources, the round was significantly oversubscribed and completed within six weeks. At the same time, miiCard completed a management buyout, with James Varga appointed CEO.

James Varga says: “This is a big step forward for miiCard – with a board of this calibre we are ready to take miiCard to the next level. It’s an exciting time and I can’t wait to start changing the way financial products are distributed online. Consumers want convenience and with the help of Stephen, Graham and David we can help give them exactly that.”

Set to launch in beta before the 2011 Christmas retail season, miiCard aims to fight internet fraud and protect the consumer by finally solving the issue of trust online.

Changing the way we transact online by providing a system where proof of identity can be validated entirely online and in real-time, miiCard will make online transactions easier, faster and safer. miiCard can be used as an online equivalent to the normal driver’s license, passport or photo ID checks normally conducted not only in Financial Services but a range of industries such as online trading, dating, gambling and social networking. miiCard provides a new layer of trust previously unavailable in a purely online environment.

Owned and managed by the individual, miiCard allows the consumer to track, monitor and so take control of their online identity for the first time. miiCard costs the consumer just £1 a month and is charged to the vendor on a transactional basis.

For more information contact: Sarah Lee.

About miiCard

miiCard is a revolutionary “digital passport”, powered by Yodlee, that enables users to prove their identity online for the first time to the same level of authority as a driving licence or passport would do offline. By creating trust in an environment characterised by anonymity and transient identities, miiCard will open up opportunities for business online and put internet users back in control of their personal information.

The inability easily to authenticate a user’s identity online has long posed a significant barrier to trade. Between 70% and 90% of all online financial transactions are terminated when the customer is required to provide physical proof of identity so it is imperative that businesses find a solution.

miiCard is designed to support ecommerce and eradicate this problem by enabling customers to complete complex transactions online without supplying further proof of ID.

Owned and managed by the individual, miiCard gives the user security for their personal data, allowing them to track, monitor and thus take control of their online identity. For businesses selling online to consumers, miiCard improves conversion rates, cuts operational cost and fights internet fraud.

miiCard also benefits users and vendors by creating trust between parties in a purely online environment, increasing convenience, consistency and simplicity of shopping online, speeding up transactions, reducing costs, improving customer satisfaction and easing regulatory compliance.